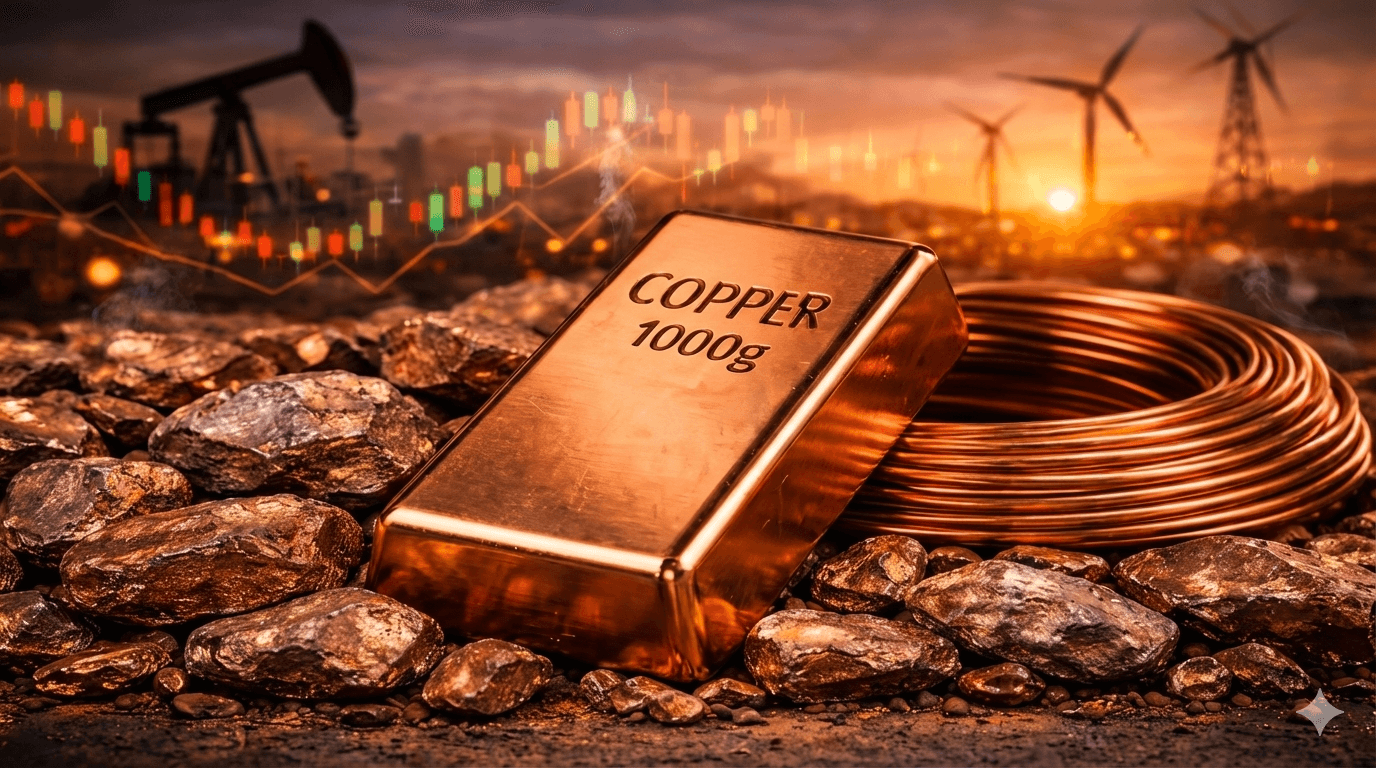

Is it the Right Time to Invest in Copper?

Copper is becoming a strategic bottleneck for global growth as electrification, AI, and clean energy drive structural demand that supply cannot easily match. India remains highly vulnerable in this shift, with rising copper consumption but limited domestic reserves and heavy dependence on imports.

Over the past year, much of the market’s attention has been on gold and silver. Investors debated safe-haven flows, central bank buying, and inflation risks.

Meanwhile, copper was quietly repricing.

Copper has always been a reliable signal of economic health. When economies expand, copper demand rises. When growth slows, copper cools off.

But today, copper is no longer just a cyclical indicator.

It is rapidly becoming a strategic bottleneck for the global economy.

According to recent analysis by S&P Global, copper is now a systemic risk — a metal without which electrification, digitisation, clean energy, and modern infrastructure simply cannot function.

Why Copper Matters More Than Ever

Copper’s most important quality is its ability to conduct electricity extremely efficiently while resisting corrosion. That combination makes it durable, reliable, and irreplaceable.

Almost every modern electrical product depends on copper — from household appliances and smartphones to factories, power grids, and industrial machinery.

What has changed is where copper is now being used.

Copper has become foundational to:

- Electric vehicles

- Renewable energy systems (solar and wind)

- Power transmission and grid upgrades

- Data centres and AI infrastructure

- Defence and advanced manufacturing

A conventional petrol or diesel car uses roughly 20–25 kg of copper.

An electric vehicle uses 80–90 kg, nearly four times more.

As countries race to electrify transport, decarbonise energy, and digitise their economies, copper demand rises exponentially.

And there is no easy substitute.

Aluminium cannot match copper’s performance in high-efficiency electrical systems.

Silver conducts electricity even better, but its cost makes it impractical for mass adoption.

Demand is Structural, Not Cyclical

Global electricity consumption is expected to grow by nearly 50% by 2040. Copper demand is projected to rise at almost the same pace, from about 28 million tonnes today to over 42 million tonnes.

The demand drivers are not speculative. They are structural:

- Economic growth and urbanisation

- Energy transition and renewable expansion

- Grid modernisation

- AI and data centres

- Defence modernisation

Asia-Pacific, led by China, is expected to dominate this demand. AI and data centres alone have emerged as a powerful new source of copper consumption due to their immense electricity needs and copper-intensive hardware.

Prices Are Rising for a Reason

Copper prices on the London Metal Exchange recently crossed $13,000 per tonne and continue to trade near historically elevated levels.

This is not driven by speculation.

Prices are reflecting a deeper problem:

The world needs far more copper than it is able to produce.

Why Copper Supply Cannot Respond Quickly

Copper mining is one of the most capital-intensive and time-consuming industries in the world.

From discovery to production, a copper mine can take 15-20 years to become operational. The process involves geological surveys, environmental clearances, land acquisition, drilling, and billions of dollars of upfront investment, often before a single rupee is earned.

Ironically, mining investment usually increases when copper prices are already high. By the time the new supply finally comes online, the price cycle has often turned.

Adding to the challenge:

- Ore grades are declining globally

- Production costs are rising

- Disruptions from weather, strikes, and technical issues are frequent

In recent years, supply disruptions have exceeded 5% of global production annually, even with elevated prices.

Where the Money Is - And Where It Isn’t

Mining captures the upside from high copper prices.

Smelting and refining generally do not.

Smelter margins depend on treatment and refining charges (TC/RC) — the fees miners pay to convert copper concentrate into refined metal.

Over the last decade:

- TC/RC rates have fallen from around $100 to near $20

- Smelters are competing aggressively for the limited concentrate

- Margins are compressed even during high-price environments

This explains why mining assets tend to benefit more from copper bull cycles than refining capacity.

China’s Strategic Advantage

China dominates copper refining, producing roughly 44% of the world’s refined copper. Most copper concentrate flows from Latin America — especially Chile and Peru — to Chinese smelters.

This creates a concentration risk for countries that rely on copper imports but lack domestic mining.

Where Does India Stand in the Global Copper Landscape?

India consumes around 1.8 million tonnes of copper annually, with demand rising steadily due to:

- Power grid expansion

- Renewable energy capacity additions

- Railways and metro projects

- Electric vehicle adoption

However, domestic copper mining produces only ~50,000 tonnes per year, creating a large and persistent supply gap.

India’s total copper ore resources are estimated at ~1,660 million tonnes, but reserves account for only ~164 million tonnes. These reserves are geographically concentrated:

- Rajasthan: ~52%

- Madhya Pradesh: ~23%

- Jharkhand: ~15%

At a global level, India holds just ~0.2% of world copper reserves and contributes only ~0.12% of global copper production, despite being one of the fastest-growing consumers. Per capita copper consumption in India stands at ~0.6 kg, far below the global average of ~3.2 kg, highlighting significant latent demand as electrification and infrastructure scale up.

India has only one copper miner, Hindustan Copper Limited, which controls all operating copper mines and around 45% of the country’s copper ore resources. While mining capacity expansion is underway, it remains insufficient to meet India’s growing demand.

For many years, India offset weak mining capacity by importing copper concentrate and refining it domestically. This changed after the closure of the Sterlite Copper smelter in 2018, which removed a substantial portion of midstream capacity. Since then, India has become a net importer of refined copper, increasing exposure to global supply disruptions and price volatility.

Today, India’s copper industry is skewed toward smelting and refining rather than mining. Key players include:

- Hindalco (Birla Copper): ~5 lakh tpa refined capacity

- Vedanta (Sterlite Copper): Silvassa unit operational

- Adani Group (Kutch Copper): Phase-I ~5 lakh tpa installed, under commissioning.

While new refining projects may add capacity, the absence of a secure domestic copper concentrate supply remains a structural vulnerability.

Recycling Helps, But It Cannot Solve the Gap

Copper is infinitely recyclable, and recycled copper requires far less energy than primary production. Around 30% of global copper consumption currently comes from scrap.

Even so, recycling alone cannot bridge the projected supply shortfall. Primary copper mining will remain essential for decades.

What About Prices Going Forward?

According to Goldman Sachs Research, copper prices are expected to remain structurally supported in 2026.

- Expected price range: $10,000–$11,000 per tonne

- Forecast average (H1 2026): $10,710 per tonne

- Key drivers: grid investment, AI, defence, and energy transition

Prices are unlikely to fall meaningfully unless there is a severe global demand shock.

The Bigger Picture

The world is entering an era where copper availability will influence:

- Economic growth

- Energy security

- Industrial competitiveness

- Geopolitical strategy

For India, the challenge is even sharper. Copper demand is rising faster than domestic capabilities, making global supply chains increasingly critical.

_1768996873080.png&w=3840&q=75)

_1755606872650.png&w=3840&q=75)